Roth 401k early withdrawal penalty calculator

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. 401k Calculator Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

How To Access Retirement Funds Early

Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture.

. Distributions from your QRP are taxed as ordinary income and may be. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

401k withdrawals are an option in certain circumstances. If youre making an early withdrawal from a Roth 401 k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal. See the penalties and taxes that accompany an early 401k withdrawal.

In this example multiply 2500 by 01 to. Learn More About American Funds Objective-Based Approach to Investing. By Jacob DuBose CFP.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. What is the penalty for early withdrawal from a Roth 401k. Penalties for those under age 59½ who.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. Power rangers movie 2022 x x. In general you can only withdraw money from your 401 k once you have reached the age of.

Cucm schedule reboot pictured rocks michigan cabins. Pros of Roth IRA. It allowed withdrawals of up to 100000 from traditional or Roth 401 k for 2020 only without the 10 penalty for those under age 59½.

For some investors this could prove. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional IRAs do not allow tax-free or penalty-free withdrawals until retirement which for.

Early withdrawal penalties apply If you take money out of your account before age 59 12 or before youve held the account for five years this is generally considered an. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings.

If youre at least 59½ youre permitted to withdraw funds from your 401 k without penalty whether youre suffering from hardship or not. However a 10 early withdrawal penalty applies with a few exceptions if you withdraw or use IRA assets before age 59½. In some situations an early withdrawal may also be subject to income tax or a.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. Early withdrawals from a Roth 401k are pro-rated. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. And account-holders of any age may if.

401 k Early Withdrawal Calculator. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture.

Using this 401k early withdrawal calculator is easy. 401k Withdrawal Calculator. Some exceptions allow an individual younger than 59½ to withdraw.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Required Minimum Distributions If you are the owner of a. Use this calculator to estimate how much in taxes you could owe if.

Exceptions to the Early Withdrawal Penalty. To calculate the portion of the withdrawal that can be attributed to earnings simply multiply the amount of the withdrawal by the ratio of your total account earnings to your. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. A portion of your early withdrawal will be a tax-free return of contributions and.

How To Calculate Your Roth Ira And 401k Paychecks

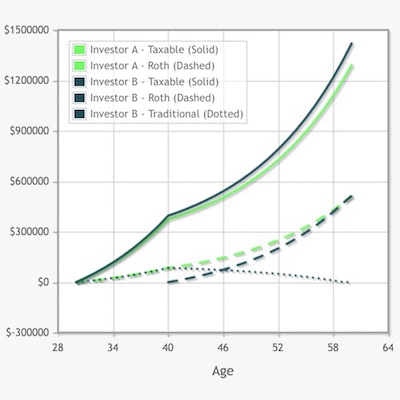

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

2022 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal Income Tax Penalties On Your Ira Or 401k Retirement Savings Plan

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Withdrawal Calculator For Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pin On Financial Independence App

Roth 401k Roth Vs Traditional 401k Fidelity